Empowering European SMEs Finom’s $54M Funding Round

European challenger bank Finom, targeting small and medium-sized enterprises (SMEs) and freelancers, has successfully raised €50 million ($54 million) in a Series B equity funding round.

Revolutionizing SME Banking

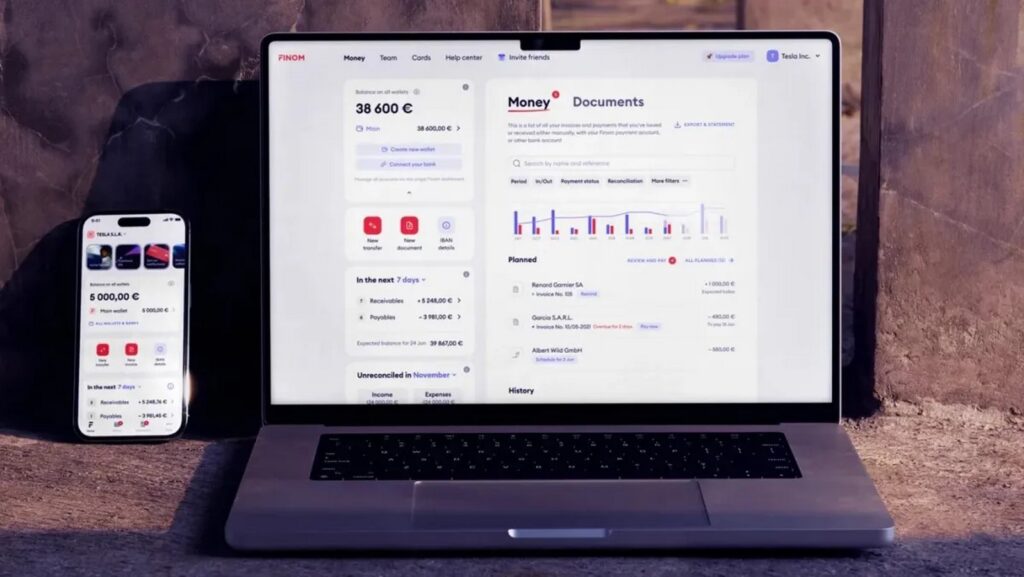

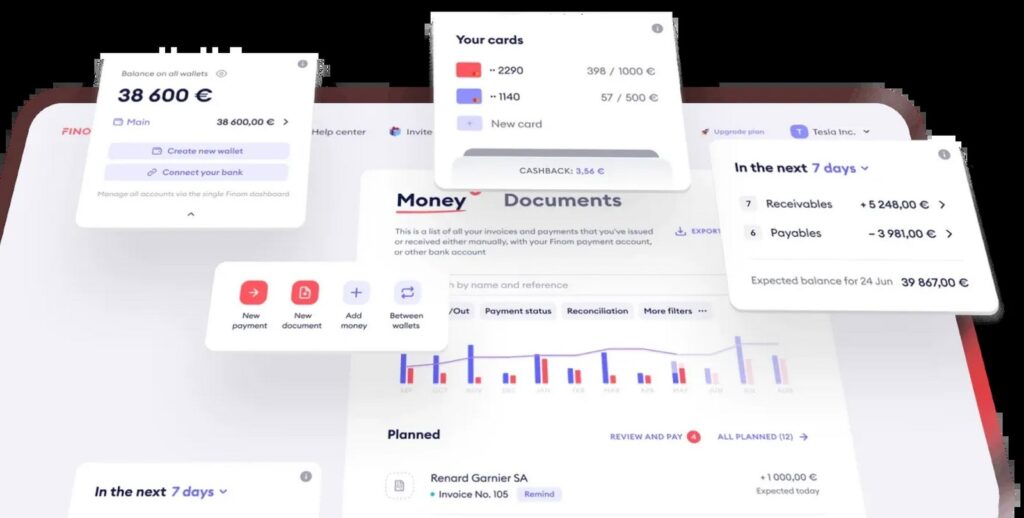

Founded in the Netherlands in 2019, Finom offers SMEs the ability to open online bank accounts swiftly, complete with an IBAN for seamless cross-border transactions. Additionally, clients gain access to physical or virtual bank cards, expense management tools, and integration support for accounting software.

Meeting Unmet Needs in the Market

Despite being one among several players in the SME banking sphere, Finom’s latest funding underscores the substantial demand for financial services tailored to SMEs in a market predominantly dominated by traditional banking institutions. The rise of challenger banks such as Atom Bank and Monument, alongside significant investments in SME lenders like Iwoca, further accentuates this demand.

Addressing SME Pain Points

Yakov Novikov, co-founder and co-CEO of Finom, emphasizes the startup’s focus on addressing the key pain points of SMEs, particularly the lack of tailored banking services from traditional banks. Novikov highlights the discrepancy between the needs of SMEs and the offerings provided by traditional banks, positioning Finom as a solution to bridge this gap.

A Comprehensive Suite of Services

Finom prides itself on offering a “fully integrated” suite of services encompassing banking, payments, invoicing, expense management, accounting, and ancillary services like business registration. This holistic approach not only saves clients time but also reduces costs by consolidating multiple services into a single platform.

Strong Financial Backing

Having previously raised approximately €50 million, including a Series A round of €33 million ($35 million) in early 2022, Finom is well-positioned for expansion. Although not classified as a bank, Finom operates under an electronic money institution (EMI) license, enabling it to offer banking-like services while focusing on its core strengths.

Expansion Plans

With the fresh capital injection, Finom aims to accelerate its expansion across the entire Eurozone, building on its existing customer base of 85,000 across key European markets. The Series B funding round, co-led by Northzone and General Catalyst, signals confidence in Finom’s growth trajectory and its commitment to revolutionizing SME banking in Europe.