Empowering Founders with Financial Insight FlowFi’s $9M Seed Funding Round

FlowFi, a startup dedicated to providing entrepreneurs with access to a marketplace of finance experts, has successfully closed a $9 million seed funding round.

Investors and Funding Details

The investment round was led by Blumberg Capital and saw participation from various investors, including Parade Ventures, Differential Ventures, Precursor Ventures, Special Ventures, 14 Peaks Capital, and Cooley LLP.

Founders’ Vision

Founded in 2021 by Nate Cavanaugh and J.J. List, FlowFi aims to automate accounting functions for founders, offering them simplified access to crucial financial metrics. Cavanaugh’s previous experience as the founder of Brainbase, acquired by Constellation Software in 2022, highlighted the challenges founders face in understanding financials without a finance background.

Bridging the Gap

Cavanaugh’s frustration with accessing accounting metrics led him to conceptualize FlowFi, recognizing the need for a solution tailored to the unique requirements of entrepreneurs. List, having witnessed similar challenges among companies in his portfolio, saw the potential in Cavanaugh’s idea and joined him to build FlowFi.

Unique Approach

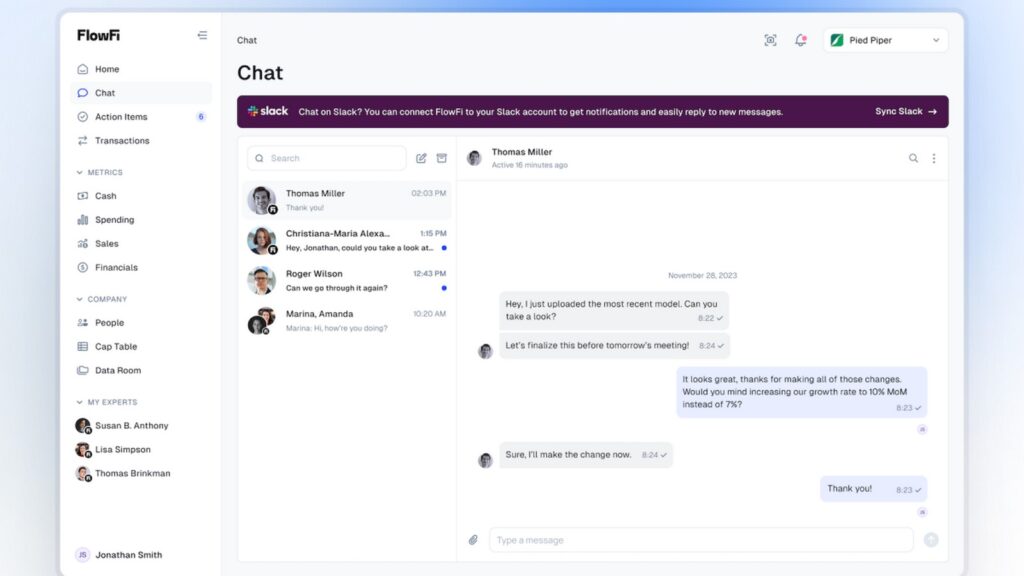

FlowFi leverages technology alongside a network of finance experts, including CFOs, accountants, and tax professionals from renowned companies like PayPal, Netflix, Headspace, and UNREAL Brands. The platform offers founders more than traditional bookkeeping, providing insights into critical non-GAAP financial metrics such as monthly and annual recurring revenue, gross margin trends, and vendor expenditure trends.

Milestones and Growth

With over 100 customers and generating millions in annual recurring revenue, FlowFi has quickly gained traction since its inception. The platform also empowers finance professionals to establish independent businesses.

Future Plans and Deployment of Capital

FlowFi plans to utilize the new funding to further develop its technology, enabling seamless integration of accounting systems for customers. Additionally, the company aims to enhance founders’ understanding of key performance indicators and expand its suite of financial expert services.

Innovating with AI

The company intends to leverage artificial intelligence to automate tasks typically handled by accountants, such as transaction categorization. Moreover, investment in sales and marketing initiatives is on the agenda to drive growth and expand market reach.

Customer-Centric Approach

List emphasized FlowFi’s customer-centric approach, highlighting the team’s firsthand experience as founders, which informs their product roadmap and ensures alignment with evolving market needs.