General Atlantic Leads $50M Series C Investment in Bold to Fuel Digital Payments Growth in Colombia

Funding Boost for Bold

Bold, a financial technology firm dedicated to establishing an electronic payments infrastructure in Colombia, has secured $50 million in Series C funding, with General Atlantic leading the investment round. The International Finance Corporation, a member of the World Bank Group, joined existing investors InQLab and Amador in the funding round. With this latest injection of capital, Bold’s total funding stands at $130 million, according to company co-founder and CEO José Vélez.

Advancing Digital Payments

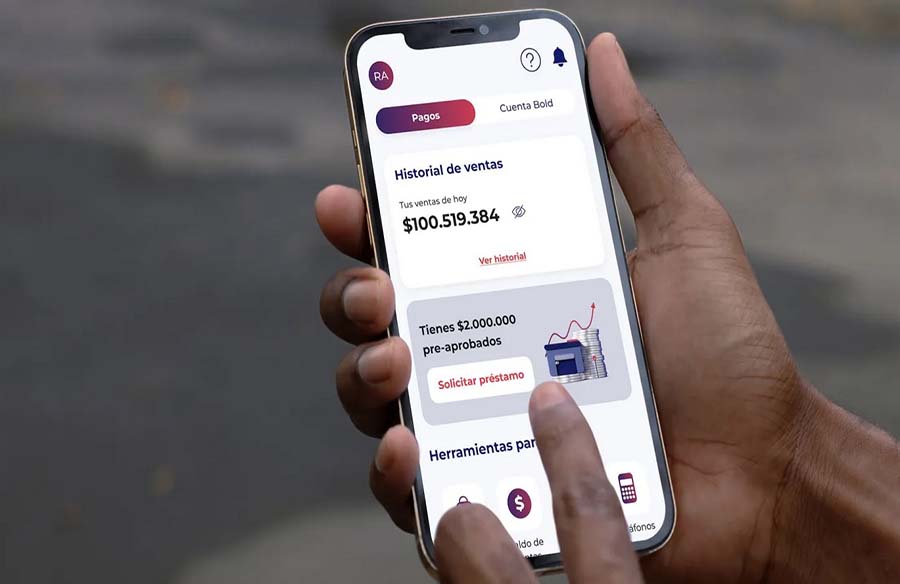

Bold’s core offering includes low-cost payment terminals, known as dataphones, which empower small and medium-sized enterprises (SMEs) to accept various payment methods, including link payments and other local alternatives. Vélez highlighted that the company has benefited from the accelerated shift towards electronic payments spurred by the COVID-19 pandemic in Colombia.

Steady Growth Trajectory

TechCrunch previously featured Bold when it raised a $55 million Series B round in 2022. Since then, the company has made significant strides, witnessing an increase in its monthly active merchants from 100,000 to 150,000. Additionally, Bold has expanded its workforce to over 800 employees, up from 380 in 2022. Revenue has surged sixfold during this period, and Bold currently commands approximately 3% of the market share in terms of transaction volume in Colombia.

Market Potential and Differentiation

While cash remains prevalent in Latin America, electronic payments are gaining momentum, particularly among younger demographics embracing credit cards and online shopping. Bold stands out by offering additional layers of services beyond payment processing. Luiz Ribeiro, managing director and co-head of General Atlantic’s Brazil office, emphasized the significance of integrating financial products like insurance and software solutions to help merchants manage their finances effectively.

Future Plans and Expansion

With the fresh capital infusion, Bold aims to enhance its product portfolio and offerings, transitioning from a payments link provider to a comprehensive solution provider for merchants. The company plans to leverage its recently acquired financial institution license to offer merchant bank accounts, facilitating cross-selling opportunities over the next 12 months. Vélez envisions Bold’s evolution into a holistic platform that not only facilitates transactions but also empowers merchants with essential financial tools and services.