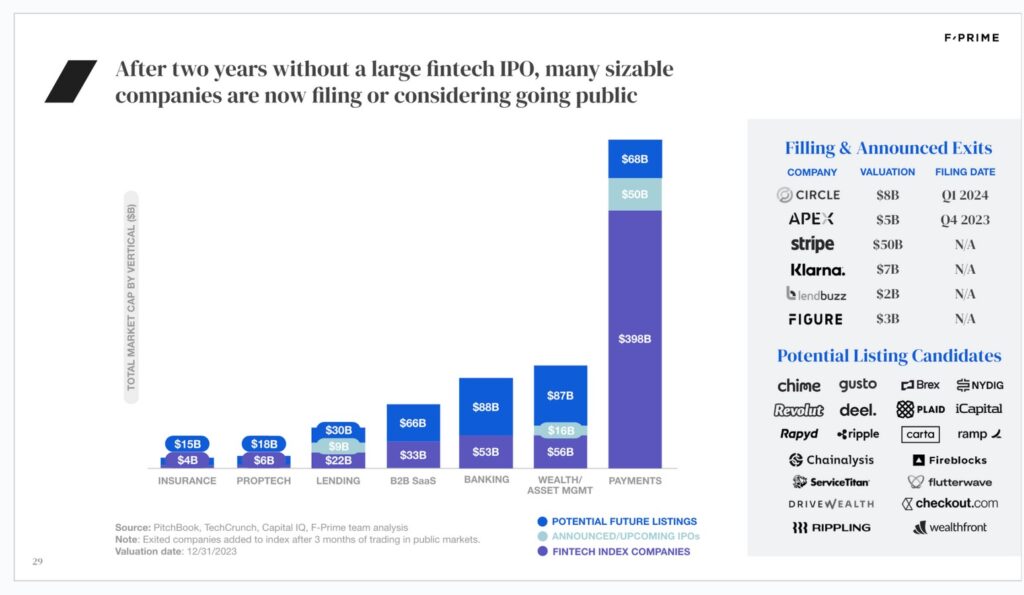

Potential Fintech IPOs in 2024

The year 2024 holds promise for the financial technology (fintech) sector, with several startups potentially gearing up for initial public offerings (IPOs). F-Prime Capital’s State of Fintech 2024 report indicates a bullish outlook for fintech companies, citing their significant revenue potential and growth prospects. Let’s explore some of the notable fintech startups that could go public this year.

Apex

Apex, a stock trade clearance firm, is reportedly considering a traditional IPO after a previous attempt via a SPAC merger fell through. While details of the offering are yet to be finalized, Apex’s move signals its intention to tap into the public markets for capital.

Stripe

Stripe, a leading payments platform, has been the subject of IPO speculation for some time. Although the company has not made any official announcements regarding its IPO plans, its significant fundraising activities and expansion efforts indicate a potential move towards going public.

Klarna

Swedish fintech Klarna has taken steps towards an eventual IPO, including restructuring its legal entity to facilitate listing on a stock exchange. With positive financial performance and a strategic focus on growth, Klarna’s IPO could be on the horizon.

Lendbuzz

Lendbuzz, an AI-driven auto finance platform, is reportedly exploring an IPO that could value the company at over $2 billion. With a track record of fundraising and growth, Lendbuzz aims to leverage the public markets to fuel its expansion plans.

Chime

Neobank Chime has been the subject of IPO rumors, although market conditions have impacted its potential timeline. Despite workforce reductions, Chime’s valuation remains substantial, making it a contender for a public debut in 2024.

Plaid

Plaid, a fintech infrastructure company, has been making strategic hires and positioning itself for a potential IPO. While the company has not confirmed specific plans, its focus on scaling its operations suggests an IPO could be in the works.

Rippling/Gusto/Deel

In the HR tech space, companies like Rippling, Gusto, and Deel have attracted significant investor interest. With strong revenue growth and market positioning, these companies may explore IPOs to capitalize on their momentum.

Brex/Ramp/Navan

Spend management startups, including Brex, Ramp, and Navan, are navigating competitive landscapes while considering public offerings. Despite challenges such as workforce reductions, these companies remain poised for potential IPOs in the coming year.

Conclusion

As fintech startups continue to disrupt traditional financial services, IPOs represent a significant milestone in their growth trajectories. While specific IPO plans may vary based on market conditions and internal strategies, the potential for fintech IPOs in 2024 underscores the sector’s resilience and long-term prospects. Investors and industry observers will be closely monitoring these developments as they unfold throughout the year.